Loading

Get Hi Dot N-20 - Schedule K-1 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-20 - Schedule K-1 online

Filling out the HI DoT N-20 - Schedule K-1 can seem daunting, but with this guide, you will find clear, step-by-step instructions to make the process easier. Follow these directions to accurately complete the form online.

Follow the steps to complete the HI DoT N-20 - Schedule K-1 online.

- Press the ‘Get Form’ button to access the HI DoT N-20 - Schedule K-1 form and open it in your preferred online editor.

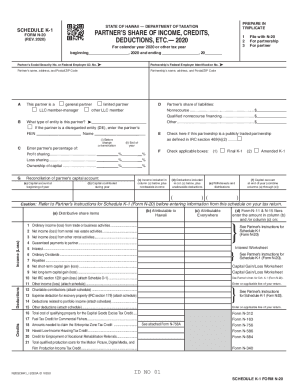

- Enter the tax year you are filing for at the top of the form. Indicate the beginning and ending dates of the tax year using the provided spaces.

- Provide the partner’s Social Security Number or Federal Employer Identification Number in the marked field.

- Fill in the partnership’s Federal Employer Identification Number in the applicable field.

- Enter the partner’s name, address, and Postal/ZIP Code in the designated section.

- Specify the partnership’s name, address, and Postal/ZIP Code in the respective section.

- Indicate the partner's status by checking the appropriate box to select whether they are a general partner, limited partner, LLC member-manager, or other LLC member.

- If the partner is a disregarded entity, provide the necessary Federal Employer Identification Number and name in the fields provided.

- Complete the reconciliation of the partner’s capital account by listing the capital account at the beginning of the year, contributions made, and withdrawals or distributions for the year.

- Record the partner’s share of liabilities by listing amounts for nonrecourse, qualified nonrecourse financing, and other types of liabilities.

- Indicate if the partnership is a publicly traded partnership by checking the appropriate box.

- Fill out the partner’s percentage of profit sharing, loss sharing, and ownership of capital in the specified fields.

- Fill in the distributive share of income, credits, and deductions in each respective section, ensuring to separate amounts attributable to Hawaii and everywhere.

- Ensure you double-check all entries for accuracy before proceeding.

- Finally, save your changes, download, print, or share the completed HI DoT N-20 - Schedule K-1 as needed.

Complete your documents online with confidence by following these steps.

Code N reports educational assistance benefits. These benefits can be deducted from partnership income up to $5,250.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.