Loading

Get Ne Form 10_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 10_DSA online

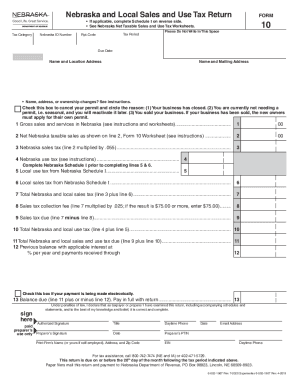

Filing the NE Form 10_DSA online is a vital task for those engaged in business in Nebraska. This guide will walk you through each section and field of the form, ensuring a clear understanding of the requirements for accurate submission.

Follow the steps to successfully complete the NE Form 10_DSA online.

- Click the ‘Get Form’ button to access the NE Form 10_DSA for completion online.

- Enter your Nebraska ID number in the designated field, which is crucial for identifying your tax account.

- Specify the tax period by writing the correct date range to ensure accurate processing.

- Fill in your name and location address. Ensure to include the correct mailing address, especially if it differs from the business location.

- For any changes in name or ownership, follow the instructions provided within the form on how to properly document these changes.

- Complete the Gross sales and services in Nebraska field by indicating the total sales amount accurately, as this will impact your tax calculation.

- Calculate and enter the Net Nebraska taxable sales according to the Nebraska Worksheets provided to assist you with accurate deductions and exemptions.

- Compute the Nebraska sales tax by multiplying line 2 by .055. Then enter this amount in the appropriate field.

- In subsequent lines, fill out any applicable local sales and use taxes using Schedule I details.

- Finally, review all entries for accuracy, and make use of available options to save, download, print, or share your completed form.

Complete and submit your NE Form 10_DSA online today to meet your tax obligations efficiently.

Any individual making a tentative tax payment and/or wanting more time to file a Nebraska income tax return, must file a Nebraska Application for Automatic Extension of Time, Form 4868N. The requirement to file Form 4868N is waived if the Nebraska tax return is e-filed through a paid tax preparer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.