Loading

Get Ne Dor 457_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE DoR 457_DSA online

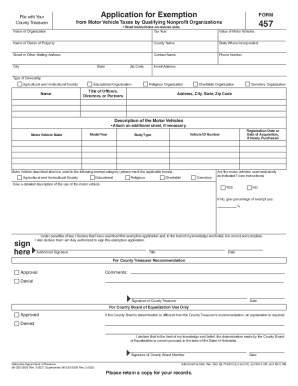

Filling out the NE DoR 457_DSA application form is a straightforward process designed to help qualifying nonprofit organizations apply for a motor vehicle tax exemption. This guide provides step-by-step instructions to ensure that your submission is accurate and complete.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to retrieve the form and open it in the designated editor.

- Begin by filling in the name of your organization and the applicable tax year. Ensure that these details accurately reflect your organization's information.

- Provide the value of the motor vehicles as well as the name of the property owner. This information is crucial for the assessment of your application.

- Next, enter the county name and the state where your organization is incorporated. This helps to identify the jurisdiction for your application.

- Fill out the street address, city, state, and zip code of your organization. Accurate contact information is essential for correspondence regarding your application.

- List a contact name and provide a phone number and email address for further communication regarding your application.

- Select the type of ownership by marking the appropriate boxes for agricultural and horticultural societies, educational organizations, religious organizations, charitable organizations, or cemetery organizations.

- In the section for description of the motor vehicles, include the make, model year, vehicle ID number, and body type. If needed, attach an additional sheet to provide further details.

- Indicate the primary use of the motor vehicle by marking the applicable use category boxes, noting if it is used for agricultural, educational, religious, charitable, or cemetery purposes.

- Answer the question regarding exclusive use of the motor vehicles as indicated. If the answer is ‘No’, provide the percentage of exempt use in the given field.

- Make sure to sign the application, providing your title and date, confirming the accuracy of the information provided and your authority to submit the application.

- Finally, review all entries for accuracy before submitting. You can then save, download, print, or share the completed form online as required.

Complete your application for a motor vehicle tax exemption online today.

How does Nebraska's tax code compare? Nebraska has a graduated individual income tax, with rates ranging from 2.46 percent to 6.64 percent. Nebraska also has a 5.58 percent to 7.25 percent corporate income tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.