Loading

Get Ne Dor 941n 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE DoR 941N online

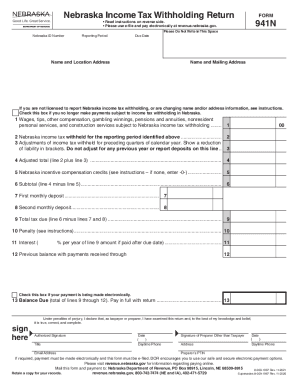

The NE DoR 941N form is essential for reporting Nebraska income tax withholding. This guide provides a clear, step-by-step approach to correctly completing the form online, ensuring compliance with state tax regulations.

Follow the steps to fill out the NE DoR 941N online effectively.

- Press the ‘Get Form’ button to access the NE DoR 941N form and open it in your preferred document editor.

- Begin by entering your Nebraska ID number, reporting period, and due date in the appropriate fields at the top of the form.

- Provide your business name and location address, followed by your mailing address if it differs from your location address.

- If you are no longer making income tax payments in Nebraska, check the designated box to indicate this change.

- On line 1, enter the total amount of wages, tips, and other compensation subject to Nebraska income tax withholding for the reporting period.

- On line 2, input the total Nebraska income tax that has been withheld for the same reporting period.

- If you need to make adjustments to the income tax withheld based on previous quarterly reports, do so on line 3. Show reduced liabilities in brackets and ensure not to report prior year adjustments here.

- Sum lines 2 and 3 for line 4 to calculate the adjusted total income tax withholding.

- If applicable, include any Nebraska incentive compensation credits on line 5; if none, enter zero.

- Calculate the subtotal by subtracting line 5 from line 6 and enter this amount on line 6.

- If there are monthly deposits, enter amounts for the first and second monthly deposits on lines 7 and 8, respectively.

- Finally, calculate the total tax due on line 9 by subtracting lines 7 and 8 from line 6.

- On lines 10 and 11, calculate any penalties and interest, if applicable, for late payments and enter those amounts.

- Fill in line 12 if you have a previous balance with the payments received, then total all amounts on line 13 to determine the final balance due. Check the box if making an electronic payment.

- Review all entries for accuracy, then sign and date the form, including your daytime phone number and email address. If a preparer is involved, they must also sign and provide their information.

- Once completed, you can save changes, download the document, print it for your records, or share it as needed.

Start filling out your NE DoR 941N online today to ensure timely compliance with Nebraska tax obligations.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.