Loading

Get Irs 8918_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8918_DSA online

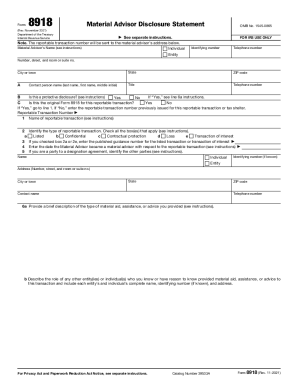

The IRS 8918_DSA, known as the material advisor disclosure statement, is essential for reporting certain transactions to the Internal Revenue Service. This guide provides clear, step-by-step instructions to help users fill out this form accurately and efficiently online.

Follow the steps to complete the IRS 8918_DSA form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Identify the material advisor by entering their name and contact details, including address and telephone number. Ensure that these details are accurate.

- Indicate whether this is a protective disclosure by selecting 'Yes' or 'No' in the appropriate section.

- Specify if this is the original Form 8918 for the reportable transaction by selecting 'Yes' or 'No'. If 'No', enter the reportable transaction number that was previously issued.

- Provide the name of the reportable transaction and identify the type of reportable transaction, checking all applicable boxes such as listed, confidential, contractual protection, loss, or transaction of interest.

- If applicable, enter the published guidance number for the listed transaction or transaction of interest.

- Input the date when the material advisor became a material advisor for the reportable transaction.

- If there are other parties to the designation agreement, list their names, identifying numbers, addresses, and contact information.

- Briefly describe the material aid, assistance, or advice provided.

- Outline the role of any other entities or individuals involved, including their names and contact information.

- Answer questions regarding related entities or individuals necessary for obtaining tax benefits and describe their roles.

- Identify the types of financial instruments used in the transaction and specify the expected tax benefits generated.

- Detail the timing of the tax benefits and enter the related Internal Revenue Code sections.

- Provide a detailed description of the reportable transaction, including expected tax treatment and benefits, roles of involved parties, and application of the Internal Revenue Code sections.

- Review all information for accuracy, then sign and date the form before submission.

Complete your IRS 8918_DSA form online today for accurate and timely submission.

A Reportable Transaction Confidential Transactions: ... Transactions with Contractual Protection: ... Loss Transactions:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.