Get Nc Dor Nc-4 Ez 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR NC-4 EZ online

Filling out the NC DoR NC-4 EZ form online is a straightforward process that will help ensure accurate withholding for your North Carolina state income tax. This guide provides clear, step-by-step instructions to assist you in completing the form efficiently.

Follow the steps to complete the NC DoR NC-4 EZ form online.

- Press the ‘Get Form’ button to access the NC DoR NC-4 EZ form and open it in your document editor.

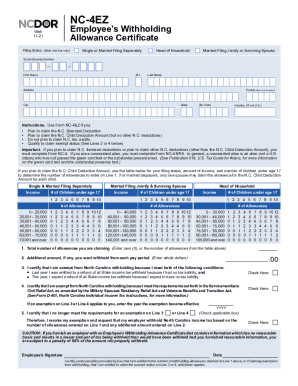

- In the first section, select your filing status by marking one box: Head of Household, Single or Married Filing Separately, or Married Filing Jointly or Surviving Spouse.

- Enter your Social Security Number in the designated field, followed by your first name, middle initial, and last name.

- Fill in the county by entering the first five letters of your county's name, along with your address, city, state, zip code, and, if applicable, the country of residence.

- Proceed to determine the total number of allowances you are claiming by consulting the provided table based on your filing status, income, and number of children under age 17. Enter this number on Line 1.

- If you wish to have an additional amount withheld beyond the allowances claimed, specify this amount in whole dollars on Line 2.

- Review the certifications on Lines 3, 4, and 5 regarding tax exemption and indicate any that apply to you by checking the respective boxes.

- Complete the signature and date fields at the bottom of the form to confirm that the information you provided is accurate.

- Once you have filled out the form, you can save changes, download your completed form, print it for your records, or share it as needed.

Complete your NC DoR NC-4 EZ form online today to ensure accurate tax withholding.

Related links form

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Fill NC DoR NC-4 EZ

NC-4EZ Employee's Withholding Allowance Certificate. Documents. Contact Information. If you plan to claim N.C. itemized deductions or plan to claim other N.C. deductions (other than the N.C. Child Deduction Amount), you must complete Form NC-4. This form can be used when members of the public seek information under the Public Records Act. NC-4EZ Department of Revenue Employee's Withholding Allowance Certificate. Documents. Contact. Mailing Address: MSC 1331, Raleigh, NC 27699-1331. FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the. N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other. You may complete Form NC-4, if you plan to claim N.C. itemized deductions, federal adjustments to income, or N.C. deductions. How many allowances should be entered on Line 1 of form NC-4 EZ?

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.