Loading

Get Fs Form 7311 - Employee's Withholding Certificate For Local ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

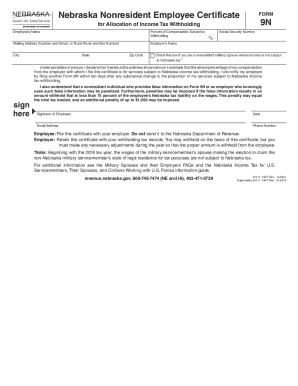

How to fill out the FS Form 7311 - Employee's Withholding Certificate For Local Taxes online

Filling out the FS Form 7311 is essential for employees to determine the appropriate withholding amount for local taxes. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to receive the FS Form 7311 and open it in your preferred document editor.

- Begin filling out the form by entering your name in the designated field as it appears on your employment documents.

- Next, provide your mailing address, including the number and street or rural route and box number.

- Then, fill in your employer’s name in the required section.

- Indicate your Social Security Number in the appropriate field to ensure accurate identification.

- In the percentage field, denote the percent of compensation that is subject to withholding.

- If you are a nonresident military spouse whose income is not subject to local tax, check the specified box.

- After filling in the details, sign and date the form in the designated areas for validation.

- Finally, review the completed form for accuracy, then save changes, download, print, or share as needed.

Complete your FS Form 7311 online today to ensure your tax withholdings are accurate.

Every employee is asked to fill out a W-4, usually on the first day of the job. Failure to do so could result in you paying too much or too little taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.