Loading

Get Irs 8846 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8846 online

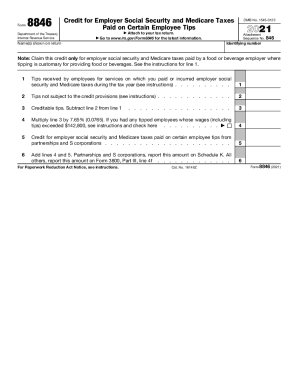

The IRS Form 8846 is used by certain employers in the food and beverage industry to claim a credit for Social Security and Medicare taxes paid on employee tips. This guide will help you navigate the form step-by-step, ensuring you fill it out accurately and efficiently.

Follow the steps to complete the IRS 8846 online.

- Press the ‘Get Form’ button to access the IRS Form 8846 online and open it for editing.

- In the field for the identifying number, enter your Employer Identification Number (EIN) or the taxpayer identification number associated with your business.

- For the name field, input the name(s) as they appear on your tax return.

- Line 1 requires you to enter the total tips received by employees for services on which you incurred Social Security and Medicare taxes. This pertains to tips for providing, delivering, or serving food or beverages.

- On Line 2, determine the tips not subject to the credit by calculating any tips accounted for that were used to meet the federal minimum wage. Enter this value here.

- Line 3 will be the result of subtracting the amount on Line 2 from Line 1 to find your creditable tips.

- Multiply the total from Line 3 by 7.65% and enter this result on Line 4. If applicable, check the box indicating if any tipped employee's wages exceeded the annual wage base and follow the additional instructions for this scenario.

- For any partnerships and S corporations involved, be sure to complete Line 5, reporting additional credits as necessary.

- Finally, add the amounts from Lines 4 and 5 as instructed and record this on Line 6.

- After completing the form, save your changes and prepare to download, print, or share the completed IRS 8846 as needed.

Complete your IRS 8846 online today to ensure you claim your entitled credits efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.