Loading

Get Mo Dor 149_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR 149_DSA online

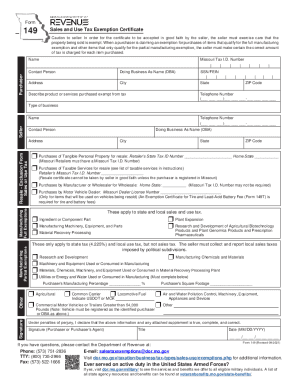

Filling out the MO DoR 149_DSA form online is an essential process for individuals or businesses seeking sales and use tax exemptions in Missouri. This guide will provide you with clear and detailed instructions to assist you in completing the form accurately.

Follow the steps to complete the MO DoR 149_DSA online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your name in the designated field labeled 'Purchaser'. Ensure this is the person or organization seeking the exemption.

- Enter your Missouri Tax I.D. number if applicable. If you do not have one, verify if you need to provide a Social Security Number or Federal Employer Identification Number.

- Fill in 'Doing Business As Name (DBA)' if applicable, followed by your complete address including city, state, and ZIP code.

- Complete the telephone number section with a valid contact number to reach you.

- In the 'Describe product or services purchased exempt from tax' section, provide a clear description of the items or services being purchased that qualify for tax exemption.

- Select the relevant type of business from the provided options to help clarify your status.

- Proceed to fill out the seller's information, including the seller's name, telephone number, and any DBA if applicable.

- Select the appropriate boxes related to the type of exemption you are claiming, ensuring that you provide any additional requested information for those selections.

- Review the declarations regarding the accuracy of your submission, and ensure you sign and date the form to validate it.

- After completing the form, you can save changes, download a copy, print it for your records, or share it as necessary.

Complete your MO DoR 149_DSA form online today to ensure your tax exemption status.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Online Copy of their driver's license. Copy of each car title (front and back), registration or renewal (front and back) and confirmation of their current address. Email the request for the waiver with the requested copies of the documents to assessor-personalproperty@stlouis-mo.gov.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.