Loading

Get Mo 2643a 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 2643A online

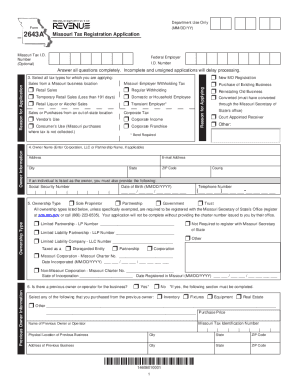

The MO 2643A is the Missouri Tax Registration Application form used to register your business for tax purposes. Completing this form accurately and fully is crucial to ensure timely processing and compliance. This guide will provide clear instructions to help you fill out the MO 2643A online.

Follow the steps to complete the MO 2643A online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in your Missouri Tax I.D. Number, if you have one, and your Federal Employer I.D. Number.

- In the tax types section, select all applicable tax types you are applying for, including sales or purchases from Missouri and out-of-state locations.

- Provide the owner information, including the owner's name, address, email address, city, state, ZIP code, and county. If the owner is an individual, include their Social Security Number and date of birth.

- Indicate the ownership type by selecting the appropriate option such as sole proprietor, partnership, or limited liability company, including any necessary charter numbers.

- If applicable, complete the section for the previous owner information. This includes selecting items purchased and providing the previous owner's details.

- Input your mailing and storage address, specifying where forms and notices should be sent and where tax records will be stored.

- List the officers, partners, or members responsible for tax matters, along with their relevant information such as title, Social Security Number, and home address.

- Complete any extra sections for transient employers or out-of-state companies if they apply to your business.

- Fill in the tax-related sections including taxable sales or purchases start dates, estimated sales tax liability, and other tax specifics as required.

- Review all entries for accuracy and completeness, ensuring no fields are left blank.

- Once finished, save your changes, download, print, or share the form as needed.

Complete your MO 2643A online today to ensure your business is registered for tax purposes.

Either the out-of-state seller will collect and remit the use tax directly to Missouri or the purchaser is responsible for remitting the tax to the department if the out-of-state seller does not collect use tax on the transaction. Local use taxes are distributed in the same manner as sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.