Loading

Get Irs 8938 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8938 online

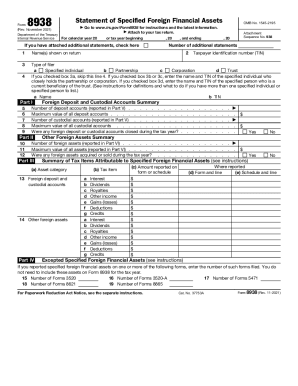

Filling out the IRS 8938 form is essential for individuals who hold specified foreign financial assets. This guide will provide step-by-step instructions on how to accurately complete the form online, ensuring that all necessary information is captured according to IRS requirements.

Follow the steps to accurately complete your IRS 8938 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year for which you are filing the form. Indicate whether it is for the calendar year or a fiscal year, specifying both the beginning and ending dates as necessary.

- Input your name as it appears on your tax return, ensuring correct spelling and formatting.

- Select the type of filer by checking the appropriate box for either an individual, partnership, corporation, or trust. If applicable, provide the name and taxpayer identification number of the specified individual associated with the selected category.

- In Part I, report the summary of your specified foreign financial assets, including categories like foreign deposits, custodial accounts, and any other foreign assets. Accurately fill in the maximum value of each asset.

- Complete Part II by detailing tax items attributable to the specified foreign financial assets. Fill in the amounts reported on the respective forms or schedules.

- Proceed to Part III and indicate any excepted specified foreign financial assets by reporting the number of additional forms filed, such as Forms 3520, 5471, etc.

- For Part IV, summarize the information about your foreign deposit and custodial accounts, specifying the number of accounts, maximum values, and whether any accounts were opened or closed during the tax year.

- In Part V, provide detailed information for each foreign deposit and custodial account. This includes account designation, maximum value, and any applicable foreign currency exchange rates used for conversion.

- Finally, complete Part VI for 'other foreign assets', reporting detailed information such as asset descriptions, values, and relevant dates for acquisitions or dispositions.

- Once you have completed the form and have reviewed all fields for accuracy, you can save your changes, download a copy for your records, print it, or share it as necessary.

Start filling out your IRS 8938 form online today to stay compliant with your tax obligations.

A financial asset that is reported on Form 8938 (FATCA) does not necessarily need to be reported on your FBAR form and vice versa.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.