Loading

Get Irs 2290 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2290 online

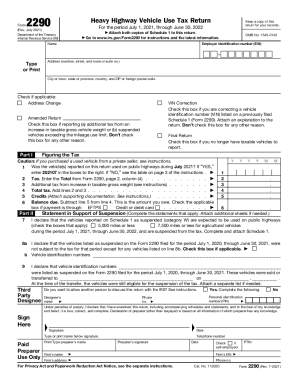

The IRS 2290 is a crucial form for individuals and businesses that operate heavy vehicles on public highways. Filing this form online can streamline the process, ensuring tax compliance while saving time. This guide provides step-by-step instructions to help users navigate and complete the form correctly.

Follow the steps to fill out the IRS 2290 online effectively.

- Click ‘Get Form’ button to obtain the IRS 2290 form and open it in the editor.

- Enter your employer identification number (EIN) in the designated field. Ensure that this information is accurate to prevent processing issues.

- Fill in your name and address, including street, city, state, and ZIP code, ensuring that all details are correct and current.

- Indicate any applicable checkboxes, such as if you are submitting an amended return or addressing a VIN correction.

- In Part I, determine if your vehicle(s) has been used on public highways during the specified period and respond accordingly.

- Calculate your total tax based on the taxable gross weight of your vehicles. Refer to the tax computation table provided in the form for accurate figures.

- Complete Part II if applicable, providing necessary statements regarding suspension of tax for certain vehicles.

- Designate a third-party designee if you want to authorize someone to discuss this return with the IRS, and complete the necessary fields.

- Review your completed form for accuracy, ensuring that all fields are filled and calculations are correct.

- Save your changes and download the completed form. You can print or share it as needed for your records.

Complete your IRS 2290 online today to ensure compliance and facilitate the management of your heavy vehicle taxes.

The filing season for Form 2290 filers is July 1 through June 30. The filing deadline for Form 2290 is based on the month you first use the taxable vehicle on public highways during the reporting period. For vehicles you first use on a public highway in July, file Form 2290 between July 1 and August 31.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.