Loading

Get Irs 943 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 943 online

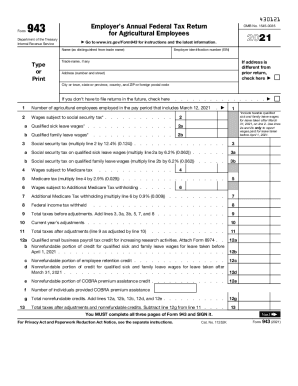

This guide provides clear instructions on how to complete the IRS Form 943, which is the Employer’s Annual Federal Tax Return for Agricultural Employees. Whether you are familiar with tax forms or new to the process, this comprehensive guide will assist you step by step.

Follow the steps to fill out your IRS 943 efficiently.

- Click 'Get Form' button to obtain the IRS Form 943 and open it in your document editor.

- Enter your name as distinguished from your trade name and provide your Employer Identification Number (EIN). If you're operating under a trade name, include that as well.

- Complete your address, including number and street, city or town, state or province, country, and ZIP or foreign postal code. If your address has changed since your last return, check the designated box.

- Indicate the number of agricultural employees you employed during the pay period that includes March 12, 2021.

- Report the total wages subject to social security tax and qualified sick leave wages in the specified fields.

- Calculate and enter the social security tax amounts in the provided areas of the form based on the multipliers indicated (e.g., 12.4% for social security tax).

- Provide details for Medicare tax, including wages and amounts subject to Additional Medicare Tax, following the instructions for each field.

- Complete the section for federal income tax withheld; ensure all values are calculated correctly.

- Review and enter totals for all taxes before adjustments, and note any current year adjustments if applicable.

- Finalize your calculations to provide the total taxes after adjustments and any nonrefundable credits.

- You must complete all three pages of Form 943, ensuring every section is filled out accurately.

- Once completed, save your changes, download the form if needed, and print or share it with your relevant parties.

Start filling out your IRS Form 943 online today for a smooth filing experience.

The IRS does not offer an extension for Form 943. Penalties for violation: A Failure to File penalty can be assessed to any employer who files late. In addition, a penalty between 2% to 15% can be assessed to any business that fails to file their 943 by the due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.