Loading

Get Irs 709 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 709 online

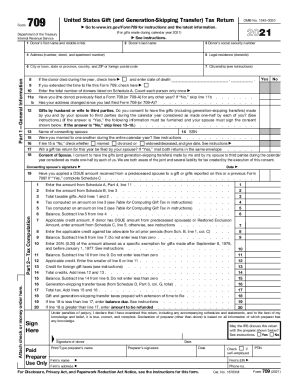

The IRS 709 form is the United States Gift (and Generation-Skipping Transfer) Tax Return, used to report certain gifts and transfers. This guide will provide step-by-step instructions on how to complete the form online, making the process clearer and more manageable for users.

Follow the steps to complete the IRS 709 form efficiently.

- Click ‘Get Form’ button to obtain the IRS 709 form and open it in the online editor.

- Fill out Part 1—General Information. This includes providing the donor’s first name, last name, social security number, address, legal residence, and other relevant details such as citizenship or if the address has changed since the last filing.

- Indicate whether you consent to have gifts made by you and your partner considered as made one-half by each. Complete lines requiring information on the consenting spouse if applicable.

- Proceed to Part 2—Tax Computation. Enter amounts from Schedule A and perform calculations to determine total taxable gifts and tax due, following instructions for accuracy.

- Complete relevant Schedules A, B, C, and D as needed. Schedule A requires you to list gifts, while Schedules B and C address previous gifts and unused exclusions from deceased spouses.

- Review all entries to ensure correctness and completeness, particularly in calculations for taxable gifts and available credits.

- After ensuring all information is accurate, save your changes. You can download the form, print it out, or share it as needed.

Start filling out your IRS 709 form online today!

The primary way the IRS becomes aware of gifts is when you report them on form 709. You are required to report gifts to an individual over $15,000 on this form. This is how the IRS will generally become aware of a gift.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.