Loading

Get Irs 8863 2021

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8863 online

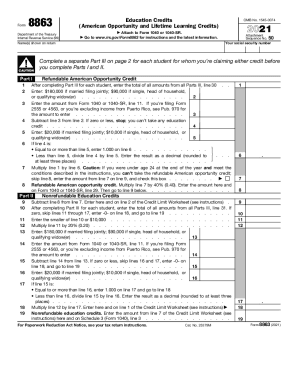

Filling out the IRS Form 8863 is essential for claiming education credits, including the American Opportunity Credit and Lifetime Learning Credit. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring users understand each component and requirement.

Follow the steps to fill out the IRS Form 8863 accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In Part I, after completing Part III for each student, enter the total amounts from all Parts III on line 1. Then, follow the instructions for entering the necessary income thresholds based on your filing status.

- Calculate your education credit by subtracting the specified amounts and determining your eligibility based on the income limits provided in the instructions.

- In Part II, complete the nonrefundable education credits section by entering the appropriate amounts based on the calculations from Part I. Ensure to account for any limits stated.

- Proceed to Part III, where you must provide information for each student. Fill in the names, educational institution details, and confirm if the required Forms 1098-T were received.

- Complete the eligibility questions regarding the student's academic status and prior credit claims, ensuring that all necessary conditions are met for each student.

- Calculate the adjusted qualified education expenses for the American Opportunity Credit and the Lifetime Learning Credit as per the guidelines, ensuring accuracy in your entries.

- Finally, review all sections for accuracy, then save your changes. You can choose to download, print, or share the completed form as needed.

Start filling out your IRS Form 8863 online today to claim your education credits!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Schedule 8812 (Form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.