Loading

Get Ga Dor G-7 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR G-7 online

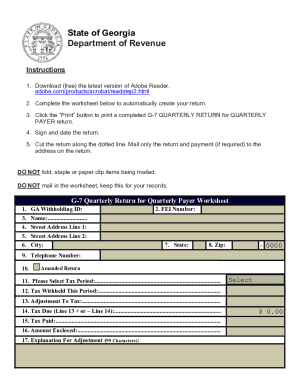

Filling out the GA DoR G-7 is essential for individuals who are required to report quarterly withholding taxes. This guide provides a clear, step-by-step approach to help users complete the form online with ease.

Follow the steps to successfully complete the GA DoR G-7 form online.

- Press the 'Get Form' button to acquire the form and open it for editing.

- Enter your GA Withholding ID in the designated field to identify your tax account.

- Input your FEI Number in the appropriate section to track your federal employer identification.

- Provide your full name as it appears in official records.

- Fill in your Street Address Line 1, followed by Line 2 if necessary, to ensure accurate mail delivery.

- Enter your City, State, and Zip Code to complete your address.

- Add your Telephone Number for any necessary follow-up.

- If applicable, check the box to indicate you are filing an Amended Return.

- Select the Tax Period you are reporting for using the provided dropdown menu.

- Input the amount of Tax Withheld for this period in the respective field.

- If necessary, enter any Adjustment to Tax amounts to reflect changes in prior filings.

- Calculate your Tax Due by summing or subtracting using the amounts from the previous fields.

- Report the amount of Tax Paid in the specified section.

- Complete the Amount Enclosed section to indicate any payment being submitted with the form.

- Provide a brief Explanation for any adjustments made within the character limit specified.

- Once all details are filled out, save your changes, then proceed to download or print the completed form.

- Sign and date your form, and remember to cut it along the dotted line to separate it before mailing.

- Mail only the completed return and payment (if applicable) to the address provided on the form.

Complete your GA DoR G-7 online today and ensure timely submission to avoid penalties.

Withholding Formula (Residents) (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Georgia Tax Withholding Should Be:Over $0 but not over $7501.0%Over $750 but not over $2,250$7.50 plus 2.0% of excess over $750Over $2,250 but not over $3,750$37.50 plus 3.0% of excess over $2,2503 more rows • 4 Mar 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.