Loading

Get Mo Dor 2827_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR 2827_DSA online

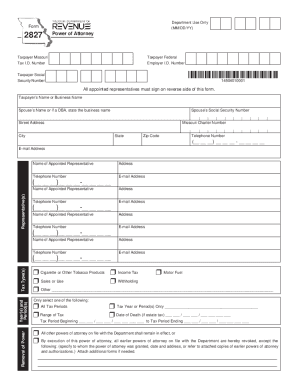

The MO DoR 2827_DSA is a vital document for designating a power of attorney for tax matters in Missouri. This guide will provide you with clear, step-by-step instructions on how to properly complete this form online, ensuring that you understand each component and can effectively input your information.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the MO DoR 2827_DSA and open it in your preferred online editor.

- Begin by filling out the taxpayer's information. Provide the taxpayer's name or business name, and if applicable, the spouse's name or business name, in the designated fields.

- Enter the taxpayer's Social Security Number or the Employer Identification Number. This information is crucial for identification purposes.

- Input the complete address, including street, city, state, and zip code. Make sure this information is accurate to prevent delays.

- Fill in the telephone number and email address for the taxpayer to ensure accurate communication.

- List all appointed representatives by entering their names, addresses, telephone numbers, and email addresses in the appropriate sections.

- Indicate the specific powers being granted by providing the years and periods for which the power of attorney is being requested, as well as the type of tax relevant to the powers you are granting.

- If applicable, specify the range of tax periods or indicate if this power of attorney applies to all tax periods.

- Complete the signature section by ensuring that all taxpayers and appointed representatives sign and date the form where indicated.

- Review all entered information for accuracy. Once completed, you can save changes, download a copy for your records, print the form, or share it as necessary.

We encourage you to complete your MO DoR 2827_DSA and any other required documents online for a more efficient process.

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.