Loading

Get Ma 355-7004_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA 355-7004_DSA online

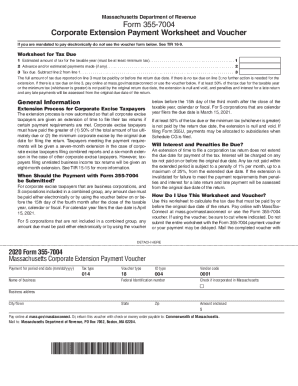

Filling out the MA 355-7004_DSA form online is a straightforward process that helps corporate excise taxpayers manage their extension payments effectively. This guide provides clear and concise steps to assist users in completing the form with confidence.

Follow the steps to fill out the MA 355-7004_DSA form seamlessly.

- Click ‘Get Form’ button to access the form and open it in your browser.

- In line 1, enter the estimated amount of tax for the taxable year. Ensure this amount meets the minimum tax requirement.

- In line 2, input any advance or estimated payments made towards your tax obligation.

- Line 3 is where you will calculate your tax due by subtracting the amount on line 2 from the amount on line 1.

- If the calculated tax due is greater than zero, ensure you pay this amount by the return due date to avoid penalties.

- If you are submitting the voucher, complete the voucher section by providing the necessary details such as business name, identification number, and amount enclosed.

- Once you have completed the form and any necessary vouchers, you can save your changes, download the document, or print it for submission.

Complete your forms and submit them online to ensure timely processing of your extension payment.

The state of Massachusetts doesn't require any extension Form as it automatically grants extensions up to 6 months for businesses. File Form 7004 and Extend your Federal Business Income Tax Return Deadline up to 6 Months.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.