Loading

Get Ma Schedule Ec 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule EC online

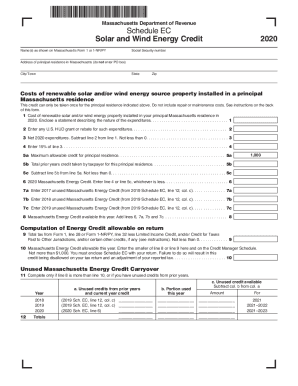

Filling out the MA Schedule EC is an essential step for individuals seeking to claim credits for solar and wind energy investment. This guide will walk you through each component of the form, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete the MA Schedule EC online

- Click ‘Get Form’ button to obtain the form and open it in the appropriate online editor.

- Input the name(s) as shown on Massachusetts Form 1 or 1-NR/PY in the designated field.

- Enter your social security number accurately in the corresponding section.

- Provide your principal residence address in Massachusetts, ensuring not to include a P.O. Box. Include your city or town, state, and zip code.

- Report the total costs of installed renewable solar and/or wind energy source property at your principal residence for the year 2020. Make sure to exclude any repair or maintenance costs and attach a statement detailing the nature of the expenditures.

- Input any U.S. HUD grants or rebates you received for the renewable energy expenditures in the specified field.

- Calculate the net expenditures for 2020 by subtracting the amount from step 6 from the amount in step 5, and ensure that the result is not less than zero.

- Enter 15% of the net expenditures calculated in step 7.

- Input the maximum allowable credit for your principal residence, which is typically $1,000.

- If you have previously claimed any credits for this residence, enter the total prior years' credit taken.

- Subtract the prior years' credit from the maximum allowable credit to find the available credit for the current tax year.

- In the specified field, enter the lesser value between the 15% calculated in step 8 and the amount from step 11.

- If you have any unused Massachusetts Energy Credits from prior years, provide those details in the respective fields.

- Finally, review all entries for accuracy, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your documents online today to ensure you take advantage of available energy credits.

The installation of the system must be complete during the tax year . Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.