Loading

Get Form7004 For Instructions And The Latest ... - Irs Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-370-PF for automatic extension online

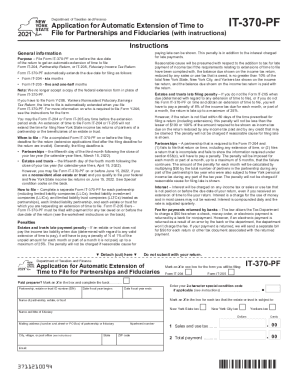

Filing for an automatic extension can provide you with the additional time needed to complete your partnership or fiduciary tax returns effectively. This guide offers clear, step-by-step instructions on how to fill out Form IT-370-PF for partnerships and fiduciaries online.

Follow the steps to successfully complete your Form IT-370-PF.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the partnership, estate, or trust identification number (EIN) in the designated box.

- Indicate the fiscal year start and end dates for your partnership or fiduciary entity.

- Choose the form you will be filing by marking an X in the appropriate box for either Form IT-204 or Form IT-205.

- If applicable, enter your 2-character special condition code in the designated area.

- Complete the section for each tax the estate or trust is subject to by marking an X in the provided boxes.

- Fill out the name and mailing address for the partnership, estate, or trust, ensuring accuracy for proper crediting of payments.

- Enter the total New York State, New York City, and Yonkers income tax liabilities for 2021 as per the worksheet provided.

- Complete the total payment line by subtracting any pre-existing tax payments from the total income tax liabilities.

- Review all information for completeness and accuracy, then finalize the form, and choose to save changes, download, print, or share it.

Complete your Form IT-370-PF online for an efficient filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.