Loading

Get Ny It-631 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-631 online

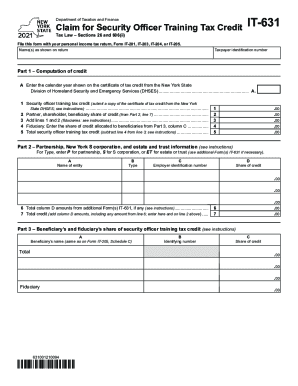

Filling out the NY IT-631 is an important process for individuals seeking to claim the security officer training tax credit. This guide will provide you with clear, step-by-step instructions on how to complete the form accurately and efficiently.

Follow the steps to complete the NY IT-631 form online.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- In Part 1, enter the calendar year indicated on the certificate of tax credit you received from the New York State Division of Homeland Security and Emergency Services (DHSES).

- On line 1, input the amount of the security officer training tax credit shown on the certificate from DHSES.

- For line 2, enter the share of the credit that corresponds to partners, shareholders, or beneficiaries as indicated from Part 2, line 7.

- Calculate the sum by adding lines 1 and 2 and enter the total on line 3.

- Fiduciaries should enter the allocated share of the credit to beneficiaries on line 4.

- Complete line 5 by subtracting line 4 from line 3 to determine your total security officer training tax credit.

- In Part 2, provide the type of entity (Partnership, S Corporation, or Estate/Trust) and fill in the name, taxpayer identification number, and share of credit for each entity.

- If needed, add any additional forms of IT-631, ensuring the totals are carried over accurately to line 6.

- For Part 3, list each beneficiary's name and taxpayer identification number along with their respective shares of the credit.

- Once you have completed all sections, save your changes, and you can download, print, or share the form as needed.

Begin filling out your NY IT-631 form online today to ensure you claim your security officer training tax credit efficiently.

New York's Empire State Child Tax Credit is a refundable credit for full-year New York State residents with children who qualify for the Federal Child Tax Credit and are at least four years of age. The Federal Child and Dependent Care Credit is a tax credit offered by the federal government.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.