Loading

Get Nm Trd Rpd-41072_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD RPD-41072_DSA online

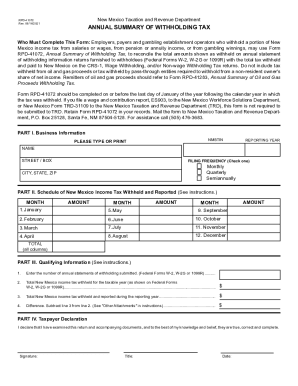

The NM TRD RPD-41072_DSA, or Annual Summary of Withholding Tax form, is an essential document for employers and payers to reconcile income tax withheld from various sources. This guide will provide clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to fill out the NM TRD RPD-41072_DSA online.

- Click ‘Get Form’ button to obtain the NM TRD RPD-41072_DSA and open it in the editor.

- In Part I, enter your business information, including your NMBTIN, the reporting year, business name, address, and city, state, ZIP code.

- Select your filing frequency by checking the appropriate box for monthly, quarterly, or semiannually.

- In Part II, for each month of the reporting year, input the amounts of New Mexico income tax withheld and reported. Ensure the reporting month corresponds to when taxes were withheld.

- At the end of Part II, calculate the total amount withheld for the year and enter it in the designated total field.

- In Part III, complete the qualifying information section by entering the number of annual statements submitted, the total New Mexico income tax withheld for the taxable year, and the total tax withheld that was reported.

- Subtract the total reported from the total withheld in Part III, line 2, and enter the difference in line 4.

- In Part IV, sign and date the form acknowledging that the information provided is true and complete.

- If applicable, prepare and attach any required documents before finalizing the form.

- Save any changes, and then download, print, or share the completed form as needed.

Start completing your NM TRD RPD-41072_DSA online now.

Single Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $6,475 but not over $11,975$0.00 plus 1.7% of excess over $6,475Over $11,975 but not over $17,475$93.50 plus 3.2% of excess over $11,975Over $17,475 but not over $22,475$269.50 plus 4.7% of excess over $17,4757 more rows • Mar 30, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.