Get Mhtd 305 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MHTD 305 online

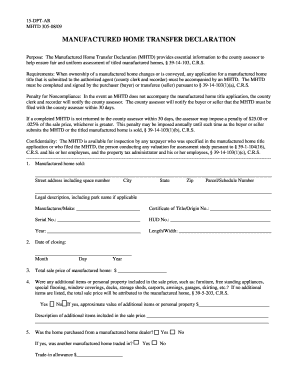

The Manufactured Home Transfer Declaration (MHTD 305) is a crucial document needed when the ownership of a manufactured home changes. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently, ensuring compliance with county requirements.

Follow the steps to complete the MHTD 305 online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the street address of the manufactured home, including the space number if applicable, along with the city, state, zip code, parcel/schedule number, and legal description.

- Provide details about the manufactured home, including the manufacturer/make, serial number, HUD number, year, and dimensions (length and width). If available, include the certificate of title/origin number.

- Indicate the date of closing by selecting the month, day, and year when the sale is finalized.

- Enter the total sale price of the manufactured home. This figure is essential for the property's assessment.

- Answer whether any additional items or personal property were included in the sale price. If yes, provide an approximate value and description of those items.

- State whether the home was purchased from a manufactured home dealer and if another manufactured home was traded in. If applicable, include the trade-in allowance.

- Indicate whether the set-up of the home was part of the sale price and note the set-up fee if applicable.

- Specify if 100% interest in the property was purchased, marking ‘no’ if only partial interest was acquired.

- Report if the parties to the transaction are related and whether the purchased home was from a community or at an auction.

- Assess the condition of the manufactured home at the time of purchase by selecting the appropriate option from new to salvage.

- If the home was financed, enter the total amount financed, type of financing, interest rates, terms, and any seller assistance or concessions.

- Sign and date the document, ensuring either the buyer or seller is clearly identified.

- Provide the mailing address and daytime phone number for any future correspondence regarding the property.

- Once all information is completed, save changes to the form, and choose to download, print, or share the document as necessary.

Complete and file your MHTD 305 online to ensure your manufactured home transfer is processed smoothly.

The MTA tax in New York applies to both employers and self-employed individuals who earn income within the affected metropolitan area. If you provide services or conduct business in this region, you will likely be subject to this tax. Knowing how MHTD 305 impacts your tax situation can help you prepare adequately and take advantage of available deductions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.