Loading

Get Wi Dor 1npr 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

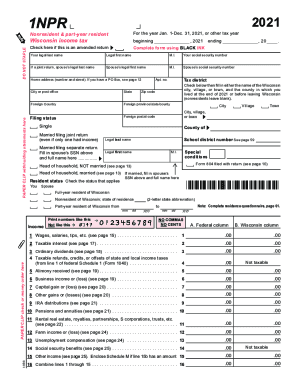

How to fill out the WI DoR 1NPR online

Filling out the WI DoR 1NPR form online can be a straightforward process when you have clear guidance. This guide will walk you through each step necessary to complete the form accurately and efficiently.

Follow the steps to complete the WI DoR 1NPR form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering your personal information in the designated fields, including your legal last name, first name, middle initial, and social security number. If you are filing jointly, include your spouse's information as well.

- Fill out your home address, ensuring that you include the apartment number if applicable. Indicate the tax district and complete the city or town section based on your residence at the end of the tax year.

- Select your filing status by checking the appropriate box—options include single, married filing jointly, married filing separately, or head of household. Make sure to follow the instructions carefully for each status.

- In the income section, complete the federal and Wisconsin columns for each type of income, such as wages, interest, or rental income. Ensure that you input the amounts clearly, without commas or cents.

- Move to the adjustments section and fill in any applicable adjustments to your income. This may include deductions for self-employed individuals, moving expenses, or contributions to health savings accounts.

- Once you have calculated your total income, proceed to the tax computation area to determine your tax liability according to the state guidelines provided.

- Complete the refund or amount you owe section by following the line item instructions. If you are expecting a refund, indicate the desired refund amount.

- Sign and date the form at the designated area. If filing jointly, have your spouse also sign and provide their details.

- Once completed, you can save your changes, download a copy, print the form, or share it as necessary.

Start filling out your WI DoR 1NPR form online today for a seamless tax filing experience.

For single taxpayers in 2023, the bottom rate of 3.54% applies to taxable income below $13,810; the second rate of 4.65% applies to taxable income between $13,810 and $27,630; the third rate of 5.3% applies to taxable income between $27,630 and $304,170; the top rate of 7.65% applies to taxable income exceeding ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.