Loading

Get Pa Dex 93_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DEX 93_DSA online

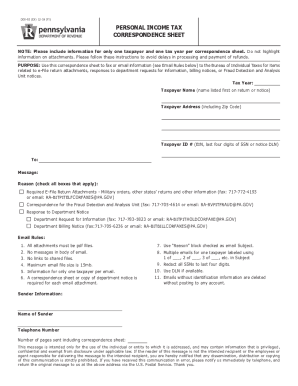

Filling out the PA DEX 93_DSA online is an essential task for taxpayers needing to communicate with the Bureau of Individual Taxes. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the PA DEX 93_DSA online.

- Click the ‘Get Form’ button to access the PA DEX 93_DSA form and open it in your preferred online editor.

- Locate the 'Tax Year' field and enter the applicable tax year for the correspondence.

- Fill in the 'Taxpayer Name' field with the name as it appears first on the tax return or notice.

- In the 'Taxpayer Address' section, provide the complete address, including the Zip Code.

- Enter the 'Taxpayer ID number' field. Use either the last four digits of the Social Security Number, Employer Identification Number, or Document Locator Number as specified.

- Use the 'Message' field to type any necessary details related to your correspondence.

- Check all applicable reasons in the 'Reason' section that pertain to your submission.

- Complete the 'Sender Information' section with your name and telephone number.

- Indicate the number of pages you are sending, including the correspondence sheet.

- After filling out all sections, ensure your information is accurate before finalizing your submission by saving the form, or choose to print or share the completed document.

Start filling out your documents online today to ensure timely processing.

Description:Step 1: Select the Form PA-40 by Tax Year below. Step 2: Fill in the space next to to "Amended Return" on the upper right-hand corner to indicate that it's an amended return. Step 3: Download, Complete Schedule PA-40X as an explanation of your amended return. Attach it to your Form PA-40.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.