Loading

Get Forms.in.govdownloadindiana Part-year Or Full-year Nonresident It-40pnr ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Forms.in.govDownloadIndiana Part-Year Or Full-Year Nonresident IT-40PNR online

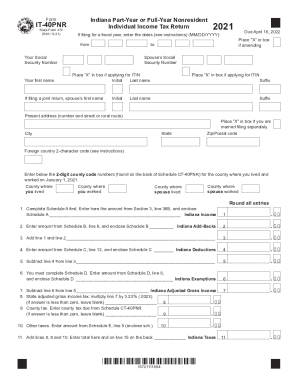

Filing your Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return (Form IT-40PNR) can be straightforward with the right guidance. This user-friendly guide will walk you through each section of the form to ensure accurate completion and submission.

Follow the steps to fill out your IT-40PNR form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the document editor.

- Enter your Social Security number and your first and last name in the designated fields. Also, provide your spouse’s Social Security number if filing a joint return.

- Indicate whether you are amending your return by placing an 'X' in the appropriate box.

- Fill in your present address, including street number and name, city, state, and zip code.

- If applicable, enter the 2-character code of your foreign country in the specified field.

- Complete the section for county codes by entering the relevant codes where you and your spouse lived and worked on January 1, 2021.

- Complete Schedule A first. Enter the total amount from Section 3, line 36B of Schedule A in the designated field for Indiana Income.

- Next, enter the amount from Schedule B, line 6 for Indiana Add-Backs, and follow the prompts to add or subtract amounts as directed through subsequent lines.

- Continue filling out the form by entering amounts from Schedule C and Schedule D as instructed, ensuring you provide details of deductions and exemptions.

- Calculate your state adjusted gross income tax, county tax due, and any other taxes owed, and consolidate these amounts in the specified sections.

- Review section for any applicable credits from Schedule F and Schedule G, entering these amounts accurately.

- Finalize your calculations by determining your refund, potential donations, any penalties, and amount due.

- If opting for direct deposit of your refund, complete the routing number and account number sections, and indicate whether this is a checking or savings account.

- Sign and date your return, making sure to read the authorization statement on Schedule H. Ensure you enclose this schedule with your filing.

- Once completed, you can save your changes, download the document, print it, or share it as necessary.

Submit your Indiana Part-Year or Full-Year Nonresident IT-40PNR form online to ensure timely and accurate processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.