Loading

Get Va Dot Ast-3 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT AST-3 online

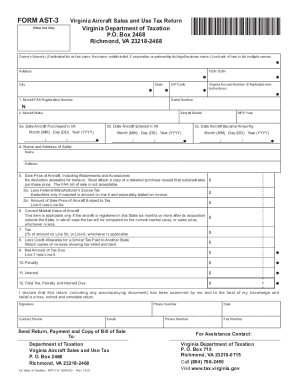

This guide provides a comprehensive overview of how to complete the Virginia Aircraft Sales and Use Tax Return, known as the VA DoT AST-3. The instructions are designed to assist individuals, including those with little legal experience, in accurately filling out the form online.

Follow the steps to effectively complete the VA DoT AST-3.

- Click the ‘Get Form’ button to obtain the VA DoT AST-3 form and open it in your online editor.

- Begin by entering the owner's name(s). If the owner is an individual, list the last name first, followed by the first name and middle initial. If the owner is a corporation or partnership, enter the legal business name. Use the back of the form if there are multiple owners.

- Next, fill in the address, City, State, and ZIP code fields accurately.

- If applicable, provide the Virginia Account Number. First-time filers may leave this section blank as an account number will be assigned when processing is complete.

- Input the Aircraft FAA Registration Number and Serial Number as specified in the provided fields.

- Enter the Aircraft Make and Model to accurately identify the aircraft in question.

- Fill in the dates related to the Aircraft purchased in Virginia, the date it entered Virginia, and the date it became airworthy using the format Month (MM), Day (DD), Year (YYYY). Ensure all dates are correctly entered.

- Provide the Name and Address of the seller. This is necessary for taxation purposes.

- Detail the Sale Price of the aircraft, including any attachments or accessories. Attach a copy of a detailed purchase receipt that substantiates the purchase price, as the FAA bill of sale is not acceptable.

- If applicable, fill in the Less Federal Manufacturer’s Excise Tax amount which should be separately stated on the invoice.

- Calculate and enter the Amount of Sale Price of Aircraft Subject to Tax (Line 5 less Line 5a).

- If the aircraft has been in Virginia for six months or more, enter the Current Market Value of the Aircraft, which is only applicable in such cases.

- Compute the Tax based on the lesser of Line 5b or Line 6, using a rate of 2%. This will be reflected in the Tax field.

- If there is a similar tax paid to another state, enter the Less Credit Allowable, along with copies of the invoices showing tax billed and paid.

- Calculate the Net Amount of Tax Due by subtracting Line 8 from Line 7.

- If applicable, include any Penalty, Interest, and Total Tax, Penalty and Interest Due based on the calculations and any late payments.

- Finally, declare the accuracy of your return by signing, dating, and entering your phone number in the designated areas.

- Once all sections are completed, save your changes and download, print, or share the completed form as required.

Complete your VA DoT AST-3 form online today for timely tax filing.

Consumer's use tax rates: The use tax rate is the same as your sales tax rate: 7% in Historic Triangle region (City of Williamsburg, and Counties of James City and York) 6% in Northern Virginia, Central Virginia and Hampton Roads regions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.