Loading

Get Form 310 See Rule 31 4 - Fill Online, Printable, Fillable, Blankpdffiller

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 310 See Rule 31 4 - Fill Online, Printable, Fillable, BlankPDFfiller online

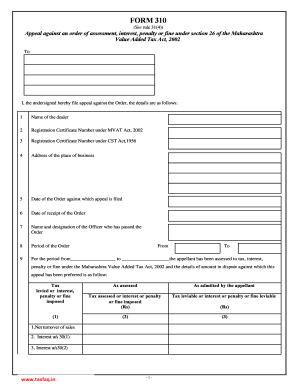

Filling out the Form 310, which is used to appeal against an order of assessment, interest, penalty, or fine under the Maharashtra Value Added Tax Act, 2002, can be straightforward with the right guidance. This guide provides a step-by-step approach to ensure you correctly complete each section of the form.

Follow the steps to successfully fill out the Form 310.

- Click the 'Get Form' button to obtain the form and open it in your preferred editing tool.

- In the first section, enter the name of the dealer as it appears on official documents.

- Input the registration certificate number under the Maharashtra VAT Act, 2002.

- Fill in the registration certificate number under the CST Act, 1956.

- Provide the complete address of the place of business.

- Enter the date of the order against which the appeal is being filed.

- Specify the date on which you received the order.

- Indicate the name and designation of the officer who issued the order.

- Detail the period of the order in the format provided.

- Complete the 'For the period from... to...' section, including all amounts related to tax, interest, penalty, or fine, making sure to clearly state the amounts as assessed and admitted by the appellant.

- In the following sections, state the quantum of relief sought, outlining any demands and refunds accurately.

- List the relevant payment details including chalan number and amounts paid at various stages.

- Include prior appeal details if applicable and the grounds for your current appeal.

- Provide any necessary declarations and signature by the appellant or an authorized person.

- Review the entire form for accuracy before saving, downloading, or printing the completed document.

Start filling out your Form 310 online now and ensure a smooth appeal process.

PF Form 3A is an Employee-wise Annual report for the Amounts deducted/contributed by the Employee and the Employer towards the EPF, VPF, and EPS Accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.