Loading

Get Loan Exception Request Form - Impac Correspondent

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Exception Request Form - Impac Correspondent online

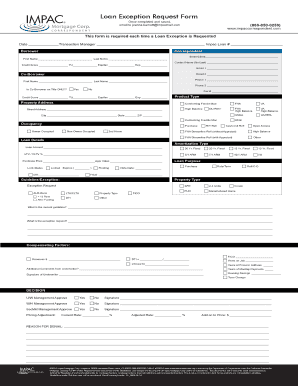

This guide provides clear and comprehensive instructions for completing the Loan Exception Request Form - Impac Correspondent online. By following these steps, users will efficiently fill out each section, ensuring all necessary information is provided.

Follow the steps to complete your Loan Exception Request Form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the date of the request. This is essential for record-keeping and processing timelines.

- In the transaction manager section, provide the name of the manager overseeing the transaction.

- Fill in the Impac loan number if available, which assists in tracking the specific loan request.

- Complete the borrower section with the necessary details, including first name, last name, credit scores from TransUnion, Equifax, and Experian.

- In the contact information section, provide the primary contact's name and two email addresses for communication purposes.

- If applicable, fill in the co-borrower's information, including names, phone numbers, and credit scores. Indicate whether the co-borrower is only on the title.

- Enter the property address accurately, including street, city, state, and zip code.

- Select the product type from the options provided, ensuring it aligns with the loan scenario.

- In the loan details section, input the loan amount, loan-to-value (LTV) and combined loan-to-value (CLTV) percentages, and the purchase price along with the appraised value.

- Indicate the lock status of the loan, including the expiration date if locked.

- Specify the amortization type that applies to the loan from the listed options.

- Detail the loan purpose, selecting one that accurately describes the reason for the loan request.

- In the exception request section, describe the guideline that requires an exception and the specific request being made.

- Provide any compensating factors that may support the exception request, including reserves, FICO scores, and DTI ratios.

- Include any additional comments from the underwriter in the specified section.

- Obtain the signature of the underwriter and any necessary approvals from management, including indications for approval or denial.

- Finally, save your changes, and ensure to download, print, or share the completed form as required.

Complete your Loan Exception Request Form online today and ensure all necessary details are submitted accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.