Loading

Get Move Money Iraesa Distribution - Ach To Checking

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Move Money IRAESA Distribution - ACH to Checking online

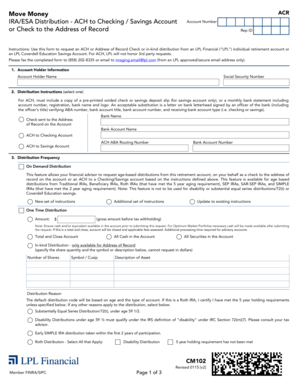

This guide walks you through the process of completing the Move Money IRAESA Distribution form for ACH transfers to your checking or savings account. By following these steps, you will ensure that your distribution request is submitted accurately and efficiently.

Follow the steps to complete the distribution form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your account holder information, including your Social Security Number and your name. This information is essential for verifying your identity as the account holder.

- Select your distribution instructions. Choose whether you want the funds to be sent via ACH to your checking account, savings account, or if you want a check sent to your address of record. If you opt for ACH, you must include a pre-printed voided check or savings deposit slip.

- Indicate the frequency of the distribution. You can choose from options such as on-demand, one-time, or periodic distributions. Make sure to specify the amount and any relevant details related to each distribution type.

- In the tax withholding section, you will need to specify if you want federal and state taxes withheld from your distribution amount. If you elect to withhold taxes, indicate the percentage or amount you wish to withhold.

- Signature and certification are required. In this section, you confirm the accuracy of the information you have provided and acknowledge responsibility for any tax implications. Sign and date the form.

- If applicable, a financial advisor or authorized person's signature is also needed for validation. This adds an extra layer of verification to the request.

- After filling out all required sections, review your form for completeness and accuracy before submitting. You can then save changes, download, print, or share the form as needed.

Complete your Move Money IRAESA Distribution request online today for a seamless transaction.

Related links form

An IRA transfer can be made directly to another account, and IRA transfers can also involve the liquidation of funds for depositing capital in a new account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.