Loading

Get Church Loan Application Form Form Iflcrm005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHURCH LOAN APPLICATION FORM FORM IFLCRM005 online

Filling out the CHURCH LOAN APPLICATION FORM FORM IFLCRM005 is an essential step for churches seeking financial support. This guide will provide you with clear and detailed instructions to complete each section of the form effectively, ensuring all necessary information is captured accurately.

Follow the steps to fill out the form online.

- Click the ‘Get Form’ button to access the form and open it in your editor.

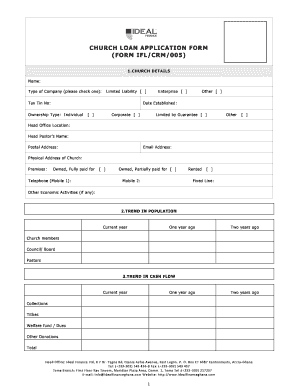

- In the CHURCH DETAILS section, fill in the church name, select the type of company, and input the Tax Identification Number. Specify the date the church was established, ownership type, and provide the head office location along with the head pastor's name and postal address.

- Complete the PHYSICAL ADDRESS OF CHURCH section by indicating if the premises are owned (either fully or partially) or rented, and provide relevant contact details, including mobile and fixed line numbers.

- In the TREND IN POPULATION section, input the number of church members, council/board members, and pastors for the current year, one year ago, and two years ago.

- Fill out the TREND IN CASH FLOW section, detailing collections, tithes, welfare fund/dues, other donations, and the total for the specified years.

- In the CHURCH BOARD OF DIRECTORS section, list the names, place/date of birth, nationality, responsibilities, years in position, academic and professional backgrounds, and provide contact information for each board member.

- Complete the BANKING RELATIONSHIP DETAILS section by specifying the current bankers along with the branch and names of authorized signatories.

- For SOURCES OF FUNDING, input the name of lending institutions, nature of finance, total amounts, and statuses for the past two years.

- In the NEW FUNDING REQUIREMENTS section, specify the loan amount requested, term in months, proposed installment amount, and the purpose of the loan. Additionally, include proposed collateral.

- Fill out the DIRECTOR’S PERSONAL GUARANTEE section with details such as full name, relationship, years acquainted, nationality, employment details, monthly income, loan facilities, and identification information.

- Complete the GUARANTOR section by providing similar details as for the director, ensuring all relevant information is included.

- In the WITNESS section, provide the witness's full name, relationship with the client, years acquainted, place of work, contact information, and have them sign.

- Review the DECLARATION section carefully, ensuring all information is accurate. Consent to the terms stated and check the relevant boxes for attached documents.

- After completing the form, you can save changes, download, print, or share the document as needed.

Begin filling out the CHURCH LOAN APPLICATION FORM FORM IFLCRM005 online today to secure your church's financial needs.

The form typically requests personal, financial, and employment information from the applicant, as well as information about the loan amount, purpose, and repayment terms. The lender uses the information provided to assess the applicant's creditworthiness and determine whether to approve or deny the loan request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.