Loading

Get Allotment Of Shares:

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ALLOTMENT OF SHARES: online

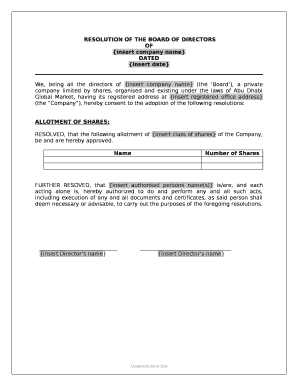

Filling out the ALLOTMENT OF SHARES form is a crucial step for companies looking to allocate shares among directors or shareholders. This guide will provide clear instructions to help users successfully complete the form online, ensuring compliance and clarity in the process.

Follow the steps to complete the ALLOTMENT OF SHARES form.

- Use the ‘Get Form’ button to access the ALLOTMENT OF SHARES document. This will open the form in an editable format for your convenience.

- Begin by entering the company name in the designated field. Ensure that the name is accurate and reflects the company as registered.

- Enter the date of the resolution in the appropriate section. This date should match the date when the board of directors made the resolution.

- List all directors of the company as part of the board in the specified area. This confirms that all directors consent to the draft resolutions.

- For the ALLOTMENT OF SHARES section, specify the class of shares that are being allocated. This could include details such as ordinary shares or preference shares.

- In the fields below, input the names of individuals who will receive the allotted shares along with the corresponding number of shares for each individual.

- Identify and input the names of the authorized persons who are empowered to execute documents related to the allotment of shares. It is important they are listed correctly as they hold authority in the process.

- Review all entered information to ensure accuracy. Make any necessary corrections before finalizing.

- Save your changes, and choose to download, print, or share the completed form as needed for your records or for compliance purposes.

Complete your ALLOTMENT OF SHARES form online to ensure a smooth and compliant allocation process.

Allotment of shares refers to the process of creating and issuing new shares by the company to the new or existing shareholders in exchange for cash or otherwise to raise more capital. Typically, a company issues new shares to attract new investors and to make them a partner in the business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.