Loading

Get Nyc Dof Nyc-3l 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF NYC-3L online

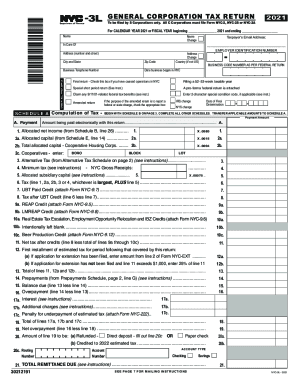

The NYC DoF NYC-3L form is specifically designed for S Corporations to report their business income and is essential for compliance with New York City tax regulations. This guide provides clear steps to help users accurately complete and submit the form online.

Follow the steps to effectively fill out your NYC-3L form.

- Press the 'Get Form' button to access the NYC-3L online form and open it for editing.

- Begin by entering your business name and any changes to your existing information as indicated in the appropriate fields at the top of the form.

- Provide your employer identification number (EIN) and ensure your business address is current, including the city, state, and zip code.

- Indicate your business telephone number and the date your business commenced operations in NYC.

- On Schedule A, compute your tax by entering allocated net income and allocated capital values, ensuring to check any relevant boxes indicating special conditions.

- Complete all necessary sections in Schedule B, which involves reporting the computation and allocation of entire net income as required by the form.

- Fill out Schedule C for subsidiary capital, providing details of your subsidiary’s capital, ownership percentages, and average values.

- Complete Schedule D by reporting your investment capital data, ensuring all relevant liabilities and values are noted.

- For Schedule E, calculate and allocate your business and investment capital, ensuring that all methods for determining average value are accurately checked.

- Finalize by reviewing all information, ensuring all necessary schedules and attachments are included, and prepare to save, download, or print your completed form for submission.

Start filling out your NYC-3L form online now for a streamlined filing experience.

The penalty charge is: 5% of the tax due for each month (or part of a month) the return is late, up to a maximum of 25%

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.