Loading

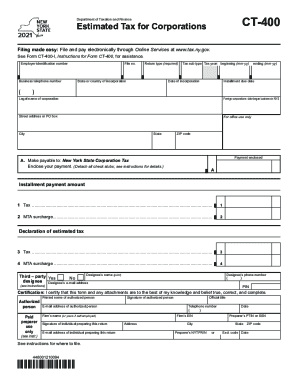

Get Form Ct 400 Department Of Taxation And Finance Ny Gov ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT 400 Department Of Taxation And Finance NY Gov online

This guide provides a comprehensive overview of how to complete the Form CT 400 for estimated tax for corporations online. Follow the steps to ensure accurate filing and compliance with New York State tax requirements.

Follow the steps to complete the Form CT 400 online.

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- Enter your employer identification number (EIN) in the designated field. This number is essential for your corporation’s tax identification.

- Provide your business telephone number in the appropriate field to ensure that the tax office can contact you if needed.

- Fill in your file number and select the return type required for your corporation.

- Indicate the state or country where your corporation was incorporated.

- Select the tax sub-type and specify the tax year, including the beginning and ending dates in the format mm-yy.

- Enter the date of incorporation accurately in the designated section.

- If applicable, state the date your foreign corporation began business in New York State.

- Provide your corporation's street address or P.O. box, followed by the city, state, and ZIP code.

- If you are enclosing payment, indicate the installment payment amount, including tax and any MTA surcharge amounts.

- Designate a third-party designee if needed, including their name, email address, and phone number.

- Complete the certification section, ensuring that the authorized person's printed name is filled out, along with their signature and contact information.

- If a paid preparer is used, fill in their details, including firm name, signature, and relevant identification numbers.

- Review all entries for accuracy and completeness.

- Finally, save your changes, and download, print, or share the completed form as needed.

Begin filling out your Form CT 400 online to ensure timely and accurate tax processing.

Using black or blue ink, make your check or money order payable to the “Franchise Tax Board.” Write your social security number or individual taxpayer identification number and “2022 Form 540-ES” on it. Mail this form and your check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.