Loading

Get Nyc Dof Nyc-245_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF NYC-245_DSA online

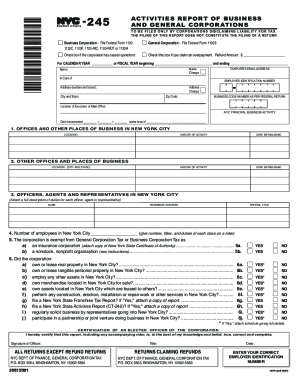

The NYC DoF NYC-245_DSA is an important form that must be filled out by corporations claiming not to be subject to the New York City General Corporation Tax or Business Corporation Tax. This guide provides a clear, step-by-step approach to assist users in completing the form online with ease and confidence.

Follow the steps to complete the NYC DoF NYC-245_DSA form online.

- Press the ‘Get Form’ button to access the NYC-245_DSA form. This will allow you to open it in your preferred online document editor.

- Begin by entering the corporation’s name and any applicable changes in the designated fields. Ensure that the name matches the legal documents of the corporation.

- Provide the taxpayer’s email address and the employer identification number (EIN) to facilitate communication and identification of your corporation.

- Fill in the corporation’s address, including the street number, city, state, and zip code. Make sure that all provided information is accurate and up to date.

- Indicate the business code number as per the federal return. This number is essential for classification purposes.

- In the section labeled ‘Location of Executive or Main Office’, provide the address where the main operations of the corporation are conducted.

- Specify the NYC principal business activity. This should reflect the main focus of your corporation’s activities.

- Record the date of incorporation and the jurisdiction under which the corporation was incorporated.

- List all offices and other places of business located in New York City, including the type of activity and the date established for each location.

- Detail any additional offices located outside of New York City, including the city and state.

- Provide information on any officers, agents, and representatives operating within New York City. Include names, residence addresses, and official titles.

- Report the number of employees in New York City, specifying titles and duties. Attach a rider with detailed information if necessary.

- Indicate if the corporation is exempt from the General Corporation Tax or Business Corporation Tax. Check the appropriate boxes and attach relevant documents when necessary.

- Respond to the various questions regarding ownership or lease of property, assets, and other activities conducted in New York City by checking ‘yes’ or ‘no’ as applicable.

- Complete the certification section by providing the signature of an elected officer of the corporation, including their title and the date of signing.

- Review the entire form for accuracy and completeness. Then, save your changes, and choose to download, print, or share the finalized document as required.

Take action today and fill out your NYC DoF NYC-245_DSA form online to ensure compliance and manage your corporation's obligations efficiently.

To pay by mail, send a check to NYC Department of Finance, P.O. Box 680, Newark, NJ 07101-0680.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.