Loading

Get Property Tax Payment Agreement Request 2020-2021 - Fill ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Tax Payment Agreement Request 2020-2021 online

This guide provides detailed instructions for users on completing the Property Tax Payment Agreement Request for the years 2020-2021. Whether you are an individual or a business, this step-by-step approach will help you navigate the application process with confidence.

Follow the steps to complete the application effectively.

- Click the ‘Get Form’ button to access the Property Tax Payment Agreement Request document online.

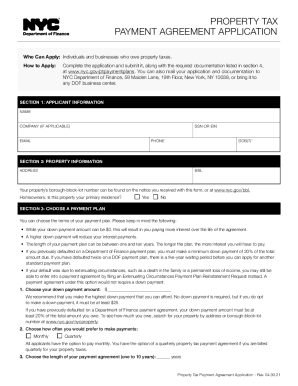

- Fill in the applicant information section. You will need to enter your full name, company name if applicable, Social Security Number or Employer Identification Number, email address, phone number, and date of birth.

- Provide property information by entering the property address and its borough-block-lot number, which can be found on the notice received with the form or at the relevant website. Indicate if the property is your primary residence by selecting 'Yes' or 'No'.

- Select your desired payment plan options. First, choose your down payment amount, which can be $0 or more; however, a higher down payment is recommended to reduce interest payments. Specify how often you would like to make payments — either monthly or quarterly. Lastly, choose the length of your payment agreement, which can range from one to ten years.

- Gather and prepare the required documentation. Individuals will need to provide a driver’s license or government-issued photo ID and a copy of the deed or power of attorney if not the owner. Businesses must submit documentation proving authorization to enter into a payment agreement.

- Review the savings opportunities on your property taxes. Check if you qualify for any exemptions that could reduce your tax burden and ensure your property is not included in the lien sale.

- Carefully read the certification section, acknowledging the terms of the agreement. Sign and date the application to affirm that all information provided is accurate. Submitting false information could lead to serious legal consequences.

- After completing the form, save your changes, and download or print the application as needed. You can also share the document if required.

Complete your Property Tax Payment Agreement Request online today to ensure timely processing.

A payment plan with the IRS where you agree to have your monthly payments automatically withdrawn from your checking account is a direct debit installment agreement (DDIA). A DDIA has several advantages: lower user fees and less chance the agreement will default.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.