Loading

Get Tax.alaska.govprogramsprogramsalaska Department Of Revenue - Tax Division

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the tax.alaska.gov Alaska Department of Revenue - Tax Division online

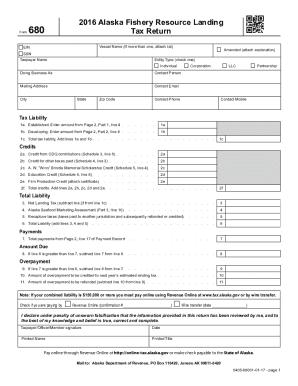

This guide provides a clear and supportive step-by-step approach for filling out the Alaska Fishery Resource Landing Tax Return online. We aim to assist users of all experience levels in successfully completing their tax return with confidence.

Follow the steps to complete your tax return effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Start by providing your vessel name in the designated field. If you are operating multiple vessels, attach a separate list as required.

- Enter your Employer Identification Number (EIN) next, followed by your Social Security Number (SSN) if applicable.

- Indicate whether this is an amended return by selecting the appropriate box and attaching a brief explanation as needed.

- Fill in your taxpayer name, ensure you indicate your entity type by checking one box for Individual, Corporation, Partnership, LLC, or Doing Business As.

- In the contact section, provide details such as your mailing address, email, city, state, zip code, and phone numbers.

- Calculate your tax liability by entering amounts from the specified pages into lines 1a and 1b, and then compute the total tax liability for line 1c.

- For each available credit, enter the credited amounts from the corresponding schedules into lines 2a through 2e appropriately.

- After calculating your total credits on line 2f, compute your Net Landing Tax by subtracting line 2f from line 1c.

- Complete the Alaska Seafood Marketing Assessment and total liabilities, ensuring you follow the instructions for each line required.

- Finally, if applicable, indicate your payment method, ensuring all required signatures, dates, and printed names are entered before saving your changes, downloading, printing, or sharing the form.

Complete your tax return online today to ensure compliance and support your continued business operations.

Since Alaska does not levy an income tax on individuals, you are not required to file an AK State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.