Loading

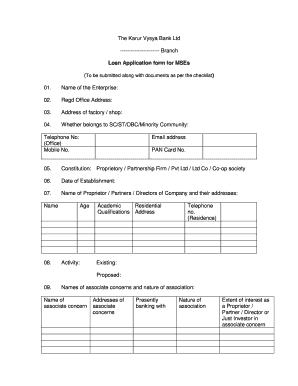

Get Msme Loan Application Form - Karur Vysya Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MSME Loan Application Form - Karur Vysya Bank online

Filling out the MSME Loan Application Form for Karur Vysya Bank is a critical step for users looking to secure financial support for their micro, small, and medium enterprises. This guide provides detailed instructions on completing the form accurately and submitting it online, ensuring a smooth application process.

Follow the steps to complete your application efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the 'Name of the Enterprise' in the first field. This should reflect the official name registered with the relevant authorities.

- Enter the 'Address of Factory/Shop'. This is crucial for the bank's understanding of your business location.

- Supply your 'Telephone No' and 'Mobile No'. Ensure that these are active numbers for contact by the bank.

- Input your 'PAN Card No.' as this is essential for tax assessment purposes.

- Note the 'Date of Establishment' of your enterprise. This date is critical for assessing the maturity of your business.

- Provide details about the 'Activity' your business engages in, and fill in the 'Residential and Academic Qualifications' of the partners or directors, including their addresses and phone numbers.

- Mention the 'Names of Associate Concerns' along with their addresses and the nature of association.

- For 'Proposed Credit Facilities,' specify the type, amount, purpose, and security offered.

- Provide historical financial performance data and future estimates to support your application.

- Affix the required photographs of the proprietor, partners, or directors in the provided spaces.

- Review the checklist of required documents and ensure everything is in order before submitting your application.

- Once you have filled all fields, save your changes. You may then download, print, or share the completed form as needed.

Begin your application process online and secure your MSME loan today.

The best 5 banks for MSME business loans are: State Bank of India. State Bank of India provides MSME loans to small business owners in various fields and has separate categories for every kind of necessity. ... Canara Bank. ... Union Bank of India. ... UCO Bank. ... Punjab National Bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.