Loading

Get Promissory Note Template Missouri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Promissory Note Template Missouri online

Filling out the Promissory Note Template Missouri requires attention to detail in order to ensure that all necessary information is accurately recorded. This guide provides clear, step-by-step instructions to help you successfully complete the form online, regardless of your prior experience with legal documents.

Follow the steps to complete your Promissory Note Template Missouri.

- Click ‘Get Form’ button to access the Promissory Note Template Missouri and open it for editing.

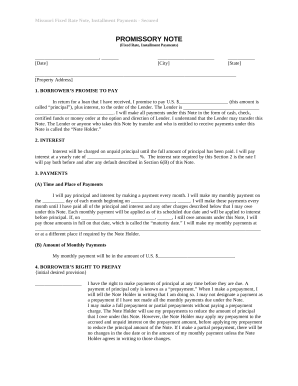

- Begin by entering the date on the first line provided. Ensure that the date reflects when you are completing the document.

- Next, fill in the city and state where the borrower resides. This information should be clearly stated and associated with the date you have entered.

- In the property address section, provide the complete address of the property that is being secured by this note. This is essential for defining the collateral for the loan.

- Under 'Borrower’s promise to pay,' write the total principal amount of the loan in U.S. dollars. Ensure it is accurate as this is the amount you are agreeing to repay.

- Identify the Lender by filling in their name and relevant information. This connects you with the party from whom you are borrowing.

- Specify the interest rate as a yearly percentage. This will detail how much interest you will be paying over the term of the loan.

- Indicate the day you will make monthly payments and the start date of the first payment. This sets your payment schedule clearly.

- Enter the monthly payment amount you will pay. Make sure this amount is manageable and aligns with the loan details provided earlier.

- If applicable, address the 'Borrower’s right to prepay' section. Decide if you want to include obligations regarding early payment and fill it out accordingly.

- Review the 'Loan charges' section and include any applicable details about loan charges that may apply to your agreement.

- Complete the sections on borrower’s failure to pay as required, ensuring you understand the implications of late payments and defaults.

- Sign the document at the end, ensuring all borrowers have signed and their names are printed clearly underneath their signatures.

- Once all sections are filled out accurately, you can save your changes, download the document, print it, or share it as needed.

Complete your Promissory Note Template Missouri online today to ensure a smooth borrowing process.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.