Loading

Get Old Mutual Loans Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Old Mutual Loans Online online

This guide provides a clear, step-by-step approach to filling out the Old Mutual Loans Online form. Whether you're familiar with loan applications or are new to the process, this comprehensive instruction will support you in completing the form accurately.

Follow the steps to complete your application

- Click 'Get Form' button to obtain the form and open it in the editor.

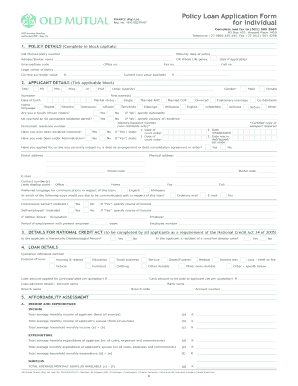

- Begin with the first section, 'Policy Details'. You will need to provide the Old Mutual policy number, the maturity date of the policy, the adviser or broker name, and indicate if it's a Whole Life policy. Fill in the intermediary code, office number, and fax number where applicable.

- Proceed to 'Applicant Details'. Select your title, input your surname, first name(s), and date of birth. Indicate your gender and select your home language from the provided list. Specify your marital status and citizenship status, ensuring to provide an identity or passport number if applicable.

- In the 'Loan Details' section, provide the quotation reference number and the purpose of the loan. Enter the loan amount you are applying for, as well as the name of your bank, branch code, and account number.

- Complete the 'Affordability Assessment' section. Include your total average monthly income and monthly expenditure from both you and your spouse or partner. Calculate and enter your total household income and expenditure, along with your monthly surplus.

- In the 'Loan Repayment Details' section, select your repayment option and method. Enter the account details where the repayments will be debited and indicate the date of the first payment.

- Review and optionally select the marketing options you're comfortable with under the 'Statement of Marketing Options' section.

- Finalize your application by signing the declaration. Ensure you have answered all questions truthfully and completely. Remember to provide your identification details in the 'Identification' section as required.

- Upon finishing the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your Old Mutual Loans Online application form today!

Related links form

Generally, borrowers need a credit score of at least 610 to 640 to even qualify for a personal loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.