Loading

Get P60 End Of Year Certificate Tax Year To 5 April 2019 - Payroo Training

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P60 End Of Year Certificate Tax Year To 5 April 2019 - Payroo Training online

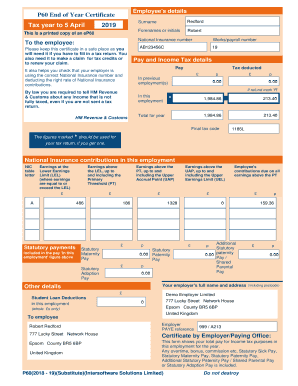

Filling out the P60 End Of Year Certificate is an essential step for employees to ensure accurate tax reporting. This guide provides a comprehensive overview of each section of the form, ensuring you have everything you need to complete it correctly and efficiently.

Follow the steps to accurately complete the P60 End Of Year Certificate.

- Click ‘Get Form’ button to obtain the P60 End Of Year Certificate and open it for editing.

- Begin by filling in the employee's details. Start with the surname and forenames or initials of the employee, ensuring the spellings are correct.

- Enter the National Insurance number of the employee. This number is crucial for tax and social security purposes.

- Record the works/payroll number, which can be helpful for internal tracking and reference.

- In the pay and income tax details section, accurately enter the total pay for the year and the total tax deducted. Ensure these values correlate with the employee's earnings.

- If there are multiple employments or if any refund is applicable, indicate this clearly by marking 'R' if required.

- Fill in the final tax code as indicated, as this will be necessary for the tax return if needed.

- Complete the National Insurance contributions section by filling in any applicable figures such as earnings above lower earnings limit, primary threshold, and any statutory payments.

- Fill in the employer's full name and address, including the postcode, to ensure proper identification.

- Finally, review all entered data for accuracy and completeness. Once satisfied, you can save the changes, download, print, or share the P60 End Of Year Certificate as needed.

Complete your P60 End Of Year Certificate online today to ensure proper tax reporting.

Give a P60 to all employees on your payroll who are working for you on the last day of the tax year (5 April). The P60 summarises their total pay and deductions for the year. You must give your employees a P60 by 31 May.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.