Loading

Get Heloc Application - Greater New Orleans Federal Credit Union

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HELOC Application - Greater New Orleans Federal Credit Union online

This guide will assist you in completing the Home Equity Line of Credit (HELOC) application for the Greater New Orleans Federal Credit Union (GNO FCU) online. By following these step-by-step instructions, you will ensure that you provide all the necessary information required for the application process.

Follow the steps to successfully fill out the HELOC application online.

- Use the ‘Get Form’ button to access the HELOC application form. This will open the form for you to begin filling it out.

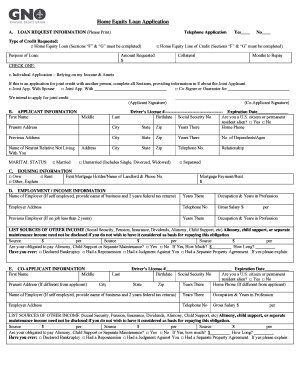

- In the 'Loan Request Information' section, indicate the type of credit you are requesting by checking the appropriate box for either a Home Equity Loan or a Home Equity Line of Credit. Provide the purpose of the loan, the amount requested, and the desired repayment duration.

- Select the applicable application type: Individual Application, Joint Application with Spouse, or Co-Signer/Guarantor. If applying jointly, ensure to sign in the designated areas.

- Complete the 'Applicant Information' section by providing personal details such as your name, driver's license number, birthdate, social security number, and current address, as well as your previous address and number of dependents.

- Fill in the 'Housing Information' section, specifying whether you own or rent your home, your mortgage payment or rent, and details about your first mortgage holder.

- In the 'Employment / Income Information' section, provide details about your employer, occupation, gross salary, and any additional income sources, including social security and pensions.

- Complete the 'Co-Applicant Information' section if you are applying jointly, ensuring all fields are filled out similarly to the applicant's information.

- If your loan is secured by real estate, fill out the 'Property to Be Mortgaged' section with the street address and type of property.

- In the 'Financial Information' section, provide details of your assets and liabilities, including cash, debts, and properties owned. Note that a current financial statement can substitute completing this section.

- Review the 'Additional Information' section and check boxes corresponding to any applicable information.

- Sign and date the application in the 'Disclosure / Signatures' section, certifying that the information provided is accurate.

- After completing the form, make sure to save your changes, download the completed document, print it if necessary, or share it as required.

Start your HELOC application online today to take advantage of great rates and terms.

At least 15 percent to 20 percent equity in your home. Equity is the difference between how much you owe on your mortgage and the home's market value. ... A credit score in the mid-600s. ... A DTI ratio of no more than 43 percent. ... An adequate income. ... A reliable payment history.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.