Loading

Get Invoice-template-service-2tax-basic.xlsx. Partner's Instructions For Schedule K-1 (form 1065)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Invoice-template-service-2tax-basic.xlsx. Partner's Instructions For Schedule K-1 (Form 1065) online

This guide aims to provide clear, step-by-step instructions on how to fill out the Invoice-template-service-2tax-basic.xlsx, which is essential for partners in reporting income, deductions, and credits. Follow these instructions to ensure accurate completion of the document.

Follow the steps to accurately complete your invoice form

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

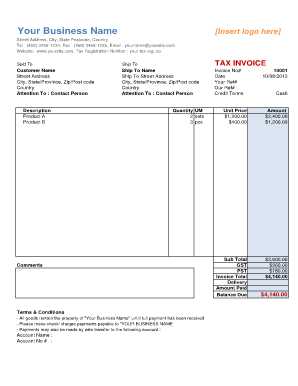

- Fill in the 'Your Business Name' section at the top of the document with your official business name and insert your logo if applicable.

- Complete the street address, city, state, postcode, and country fields for both 'Sold To' and 'Ship To' sections, ensuring accuracy in customer details.

- Assign an invoice number and date for tracking purposes. Include your reference number and any other relevant identifiers.

- Fill out the description area with the products or services provided, ensuring to include specific information such as 'Product A' and 'Product B'.

- Indicate the quantity and unit of measure for each product, providing clear details for the customer.

- List the unit price for each item and calculate the total amount, ensuring accurate addition for the subtotal.

- Add any applicable taxes such as GST and PST, ensuring these are calculated correctly.

- Complete the invoice total field by summing the subtotal and taxes to provide a final amount due.

- Include terms and conditions regarding payment methods, and ensure your bank account information is accurately stated for wire transfers.

- Finally, review all entries for accuracy. Save changes, and then download, print, or share the invoice as required.

Start filling out your documents online today to ensure proper record-keeping and compliance.

Code C - Nondeductible expenses Amounts reported as Code C are not considered deductible as these are expenses paid or incurred by the partnership. You will use this amount to adjust your basis of interest in the partnership.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.