Loading

Get Vat 14

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 14 online

Filling out the Vat 14 online is a straightforward process that requires attention to detail. This guide is designed to provide comprehensive, step-by-step instructions to help users correctly complete the form and submit it efficiently.

Follow the steps to confidently fill out the Vat 14 form online.

- Click ‘Get Form’ button to download the Vat 14 form and open it in your preferred editor.

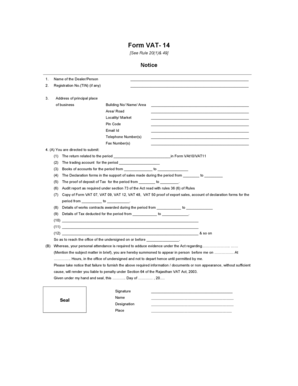

- Provide the name of the dealer or person in the designated field.

- Fill in your principal place of business information. Include the building number, name, area, and locality.

- Complete the address section thoroughly, ensuring accurate pin code and contact information, including email and telephone numbers.

- In section 4A, submit the relevant returns related to the specified period, including Form Vat 10 or Vat 11.

- Include the proof of tax deposit and any required audit reports as stated under the relevant Act.

- Complete the details of works contracts and tax deductions related to the specified time frame.

- Review the entire form for completeness, ensuring all fields are filled out accurately.

- Save your changes and prepare to download, print, or share the completed form as required before submitting.

Complete your Vat 14 submission online today to ensure compliance and avoid penalties.

Related links form

The VAT Code is typically a numeric identification number of a component that determines the VAT method and VAT rate to apply. The VAT Code is typically a numeric identification number of a component that determines the VAT method and VAT rate to apply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.