Loading

Get Gp5479us 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GP5479US online

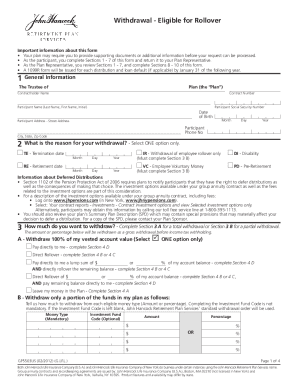

The GP5479US form is a crucial document for individuals looking to withdraw money from their retirement plans. This guide provides clear and detailed instructions on how to effectively complete this online form, ensuring that you make informed decisions regarding your retirement funds.

Follow the steps to easily complete the GP5479US form online.

- Click the ‘Get Form’ button to access the GP5479US form and open it in an online format for editing.

- Provide your general information in Section 1, including the Trustee of the plan, contractholder name, participant details, and date of birth.

- In Section 2, select the reason for your withdrawal by choosing one option that best describes your situation, such as termination, disability, or retirement.

- Fill out Section 3 to indicate the amount you wish to withdraw. Choose either a total withdrawal or specify details for a partial withdrawal.

- Complete Section 4 regarding how you wish to handle your funds. This may include opting for a direct rollover, a cash distribution, or leaving funds in the plan.

- Indicate your preferences for how you would like the funds to be sent in Section 5, selecting options for direct deposit or payment by check.

- Check Section 6 if you wish to waive the 30-day consideration period for your withdrawal.

- Sign and date Section 7, certifying your understanding of the consequences of your withdrawal and that the information provided is accurate.

- Once all sections are filled out, review your information for accuracy, and submit the form according to your plan administrator's instructions.

Start completing your GP5479US form online now to ensure a smooth withdrawal process from your retirement plan.

Filling out an EZ tax form requires that you have basic personal information handy, such as your filing status and income details. You'll fill in your wages, interest, and any adjustments to income, as well as determine your tax owed or refund. If you need guidance on this process in relation to GP5479US, peruse the US Legal Forms website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.