Loading

Get Fsa1 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FSA1 online

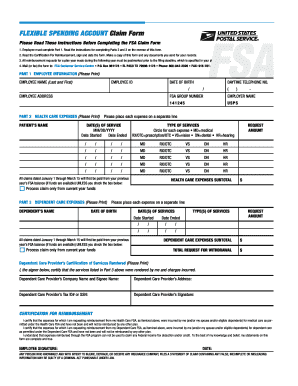

Completing the Flexible Spending Account Claim Form (FSA1) online can simplify the process of claiming your eligible expenses. This guide provides clear and detailed instructions to help you navigate each section of the form with ease.

Follow the steps to successfully complete your FSA1 online.

- Press the ‘Get Form’ button to access the FSA1 form and open it in the digital editor.

- In Part 1, enter your employee information. This includes your full name, employee ID, date of birth, address, daytime telephone number, and FSA group number. Ensure all details are accurate and clearly printed.

- Move to Part 2 for health care expenses. List each health care expense separately. For each entry, provide the patient’s name, date(s) of service, employer name, type of services (using the designated codes), and the request amount.

- In Part 2, check the box if you wish to process claims only from current year funds, indicating that you do not want to use available funds from the previous year.

- Proceed to Part 3 for dependent care expenses. Similar to Part 2, provide the dependent's name, date of birth, date(s) of services, type of services rendered, and the request amount.

- Once all relevant sections are filled out, review your entries for accuracy. Make sure you have added up your total requested amount for withdrawal.

- In the certification section, read the statement carefully and sign and date the form to confirm the accuracy of your claims.

- Before submission, ensure you have copies of all itemized receipts and documentation attached to support your claims.

- Finally, save your changes, download, print, or share the completed FSA1 form as needed for your submission.

Complete your FSA1 online today and ensure your claims are processed efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When reporting FSA on your tax return, keep in mind that contributions to your FSA are made pre-tax, which can lower your taxable income. You generally do not need to report FSA balances unless you exceed contribution limits or use the funds for non-qualified expenses. Understanding these requirements will help you accurately reflect your FSA1 information when preparing your taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.