Loading

Get Irs 11-c 2017-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 11-C online

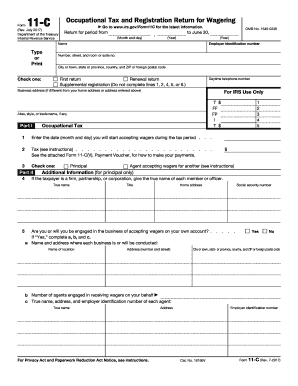

Filling out the IRS Form 11-C is essential for those engaged in wagering activities, as it secures your registration and payment of the required occupational tax. This guide provides clear, step-by-step instructions on how to complete the form online efficiently and accurately.

Follow the steps to complete the IRS 11-C form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the 'Return for period from' section. Indicate the start month, day, and year and the end year of the tax period you are registering for.

- Enter your employer identification number (EIN) in the designated field. If you do not have an EIN, you will need to apply for one online.

- In the 'Name' section, provide your full name as required. If your business has a trade name or alias, include that information as well.

- Specify the type of return you are filing by checking the appropriate box: either 'First return,' 'Renewal return,' or 'Supplemental registration.'

- Provide your 'Daytime telephone number' and 'Business address' if it differs from your home address.

- In Part I, record the date you will start accepting wagers. This is crucial as it determines your tax obligations.

- Fill out your occupational tax amount based on the type of wagers. Refer to the instructions if unsure which tax applies to you.

- For principals, provide the necessary additional information about your business partners or officers in Part II.

- If you are accepting wagers on your own account, ensure to complete sections a, b, and c under 'Yes' in Part II.

- If you are filing as an agent for another, provide the required information about the principal in Part III.

- If applicable, check the box for supplemental registration in Part IV and explain the changes made.

- Sign and date the form at the end. Ensure the signature belongs to a person authorized to sign for the taxpayer.

- After completing the form, save your changes and download it. You can then print or share the form as needed.

Complete your IRS Form 11-C online to ensure compliance with regulations and secure your operations in wagering activities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.