Loading

Get Trust Distribution Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Distribution Agreement online

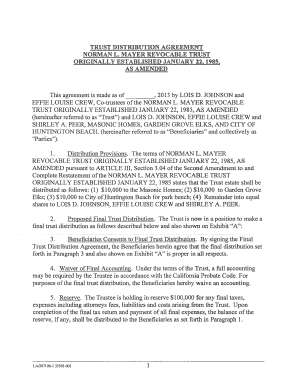

Filling out the Trust Distribution Agreement online can seem daunting, but with careful guidance, you can complete it with ease. This document outlines the distribution of trust assets among beneficiaries and sets forth the necessary provisions for the distribution process.

Follow the steps to complete your Trust Distribution Agreement.

- Click ‘Get Form’ button to obtain the Trust Distribution Agreement and open it in your preferred online editor.

- Begin by filling out the date at the top of the form, indicating when the agreement is being made. Ensure accuracy to establish the document's effective date.

- In the section titled 'Distribution Provisions', provide details about the specified amounts to be distributed to the Masonic Homes, Garden Grove Elks, and City of Huntington Beach. Follow this with the formula determining the remainder to be shared among beneficiaries.

- In the 'Proposed Final Trust Distribution' section, outline any final distributions being enacted. This should align with the referenced Exhibit 'A', which should detail the assets and liabilities being managed within the trust.

- Next, move to 'Beneficiaries Consents to Final Trust Distribution', where all beneficiaries must indicate their agreement to the proposed distribution by signing the document.

- Proceed to 'Waiver of Final Accounting' and confirm that the beneficiaries consent to waive their right to a full accounting, if applicable.

- In the 'Reserve' section, note the amount being reserved for final expenses, including taxes or attorney fees, ensuring clarity on the remaining amount post-expense.

- Document the trustee's fees in the 'Trustee's Fees' section, ensuring beneficiaries agree with the listed fee amount.

- In the 'Further Documents' section, indicate the need for each party to complete any necessary documentation for the transfer of trust assets.

- Complete the 'Mutual Releases' section, where parties release each other from potential claims or actions related to this agreement.

- Fill out the 'Indemnification' clause, where beneficiaries agree to protect the trustee from liabilities related to the trust distribution.

- Finalize by filling out the 'Binding on Successors' and 'Governing Law' sections, ensuring compliance and understanding of how this agreement is enforced.

- Sign and date the agreement in the designated areas at the end of the document. Each party must sign for validity.

- Lastly, ensure you save your changes, and consider downloading, printing, or sharing the finalized Trust Distribution Agreement for your records.

Complete your Trust Distribution Agreement online today for a smooth and efficient distribution process.

Trust Distribution Procedures means any procedures implemented in connection with a Trust to process, review and pay claims submitted to such Trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.