Loading

Get 2016 I-030 Wisconsin Schedule Cc, Request For A Closing Certificate For Fiduciaries - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 I-030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries - Revenue Wi online

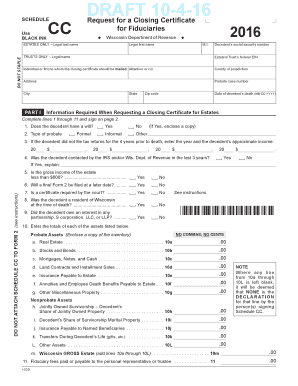

This guide provides comprehensive instructions on filling out the 2016 I-030 Wisconsin Schedule CC, a crucial form for requesting a closing certificate for fiduciaries. By following these steps, you can ensure the accurate completion of the form online.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the legal last name, legal first name, and middle initial of the decedent in the designated fields.

- Provide the decedent’s social security number and the estate's or trust's federal EIN if applicable.

- Specify the individual or firm to which the closing certificate should be mailed, including attention or c/o details, county of jurisdiction, complete address, and probate case number.

- Indicate the date of the decedent’s death in the required format (MM DD YYYY).

- Answer the questions pertaining to the decedent's will, probate type, previous IRS contact, and gross income of the estate. Provide specific income details for the last four years if applicable.

- Complete the asset sections by entering the totals of each asset type. Be sure to follow the format required (no commas, no cents). Enclose a copy of the inventory for probate assets.

- In Part II for trusts, include the required trust documents and complete the fields regarding grantors and beneficiaries.

- Finally, review all entered information for accuracy, then save your changes. You can download or print the completed form for submission.

Complete your documents online to ensure a smooth process.

Related links form

There is no estate tax for decedents dying after December 31, 2007. If the decedent died prior to 2008, see the Form W706 instructions (Estate Tax Forms) for the filing requirement for a Wisconsin estate tax return or contact the department at (608) 264-4217 for additional information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.