Loading

Get Annexure - 2 Of Schedule - B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annexure - 2 Of Schedule - B online

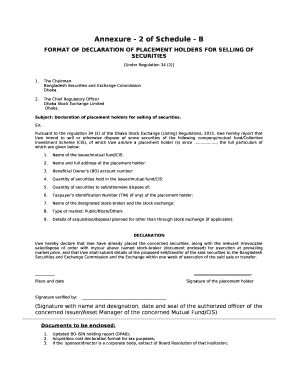

This guide provides clear instructions on how to complete the Annexure - 2 Of Schedule - B form online. By following these steps, users can ensure that their declarations are accurately filled and submitted on time.

Follow the steps to complete the Annexure - 2 Of Schedule - B form.

- Click the ‘Get Form’ button to access the Annexure - 2 Of Schedule - B form and open it in your chosen online document editor.

- Begin by entering the name of the issuer, mutual fund, or collective investment scheme (CIS) in the designated field.

- Provide your full name and address as the placement holder, ensuring all details are accurate.

- Input your beneficial owners (BO) account number in the specified section.

- Indicate the quantity of securities currently held in the issuer, mutual fund, or CIS.

- Specify the quantity of securities you intend to sell or otherwise dispose of.

- If applicable, enter the Taxpayer Identification Number (TIN) of the placement holder.

- Identify the designated stock-broker and the stock exchange in the appropriate fields.

- Select the type of market relevant to your sale: Public, Block, or Others.

- If planning disposal outside of the stock exchange, provide additional details as required.

- At the bottom of the form, ensure to review the declaration statement, then sign and date the document. If necessary, have your signature verified by an authorized officer.

- Prepare any additional documents required for submission, such as the updated BO-ISIN holding report and other relevant declarations.

- Finally, save your changes, download the completed form, print it if needed, or share it with the required parties.

Complete your Annexure - 2 Of Schedule - B submission online today.

Schedule B is an IRS tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends over the course of the year of more than $1,500. The schedule must accompany a taxpayer's Form 1040. Taxpayers use information from Forms 1099-INT and 1099-DIV to complete Schedule B.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.